Explore Borrowing Options Available from PNC

#EXPERIAN BUSINESS CREDIT SCORE RANGE HOW TO#

Knowing your score, how it was figured, and how to improve it are all vital to managing your business's financial health. Dun & Bradstreet awards extra points for businesses that settle their bills early rather than just when due.Ī business credit score is a fundamental element of your company's financial image and has a powerful effect on your ability to get credit, to get favorable terms on loans and leases, and even to get customers. Once mistakes are corrected, you can help your score by paying on time, or before. You may also write the lender or credit grantor-not the reporting agency-and request a goodwill removal of the late payment item. One way is to correct any errors by writing the reporting agency. If your score is low, such as a Paydex score of 60 indicating a history of late payments, you may be able to improve it.

#EXPERIAN BUSINESS CREDIT SCORE RANGE FREE#

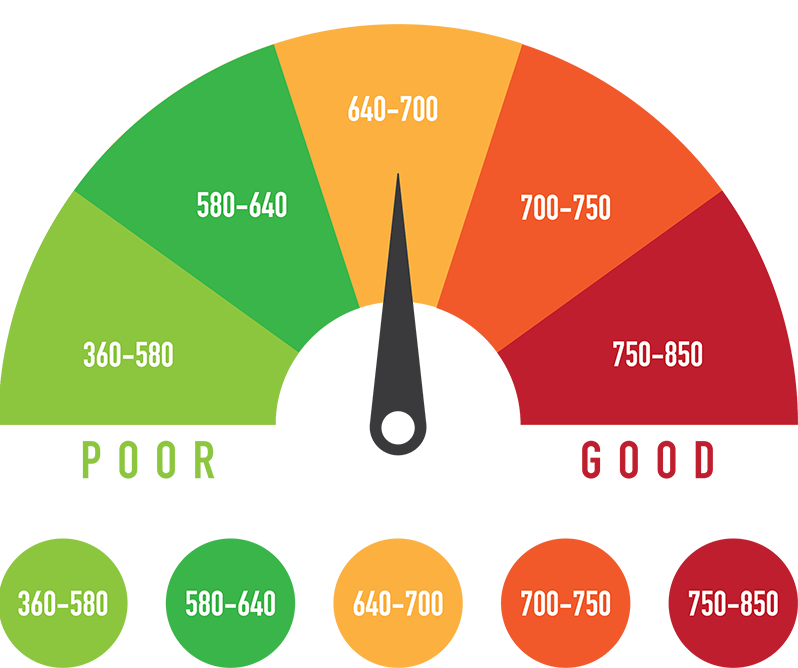

But unlike consumer credit scores, there's no federal law that requires agencies to provide a free annual score, however. It's a good idea to monitor your business credit score by requesting a score from each of the three major agencies annually, and before applying for a loan. For instance, the Equifax business failure score scale goes from 1000 to 1880. The extra scores provided by the agencies use larger scales. Each business score reporting agency uses a somewhat different method of calculating and scoring, but generally they go from 1 to 100, with 100 as the best score. The numerical scale used to represent a business credit score also differs from consumer scores. Those with business credit cards will likely have Experian and Equifax scores, but companies must apply to Dun & Bradstreet for a DUNS number to get a Paydex score.

And not all businesses have credit scores. However, lenders may also consider the owner's personal credit score when considering whether or not to extend credit to a small business. What Makes Up a Business Credit Score?Ī small business credit score looks only at the business's history, not the personal credit history of the owner. These extra scores evaluate traits such as risk of business failure. Dun & Bradstreet and Equifax also provide additional scores beyond the basic one. Experian and Equifax examine a variety of other factors, which may include company size, how long they've been in business, and collections activity. Dun & Bradstreet's Paydex score looks only at payment history, however. Īll use different sets of information to arrive at their scores. Dun & Bradstreet's Paydex is the most widely used, followed by Experian's Business Credit Ranking Score and Equifax's Suppliers Credit Risk Score. As with personal scores, there are three major business credit score suppliers. Personal Credit ScoresĪ business credit score resembles an individual credit score in some ways, but there are important differences. Increasingly, business-to-business buyers are scrutinizing a business's credit score when deciding who will get their purchase orders. Having a good credit score can make the difference in obtaining financing, getting good terms on loans and even winning new accounts. Similarly, businesses also have credit scores, and these scores possess similar ability to help or hurt. An individual's credit score can affect the ability to get a loan, rent a place to live, obtain insurance and more.

0 kommentar(er)

0 kommentar(er)